Soft Commodities Compact

The Royal Bank of Scotland Group plc (RBS) is a founding member of the Soft Commodities Compact (The Compact) which was set up in 2014. Together with eleven other financial institutions, this is a voluntary initiative led by The Consumer Goods Forum (CGF) and The Banking Environment Initiative (BEI). The Compact aims to mobilise the banking industry to help transform soft commodity supply chains, thereby helping customers to achieve zero net deforestation by the end of 2020.

Customer lending policy

RBS has an Environmental, Social and Ethical (ESE) risk management framework, established since 2011, to help assess and manage risks associated with certain customers and activities. The purpose of such due diligence is to help establish the commitment and capacity of customers to manage the potential ESE impacts in accordance with international standards. Our policies set out Prohibited, Restricted and Normal activities. We do not support customers and/or transactions involved in prohibited activities. Customers engaged in Restricted activities undergo enhanced due diligence including review by a reputational risk forum or approver and evaluation every one or two years. Customers undertaking Normal (lower risk) activities are assessed for ESE on a five-yearly basis. Access to all publicly available policies can be found in our downloads section.

The ESE framework includes a sector ESE risk appetite position for Forestry, Fisheries and Agribusiness (FFA). This includes the soft commodities which are the focus of The Compact reporting: palm oil, soy and timber. The FFA is broadly aligned with the goals of the BEI’s Compact. The policy position for FFA expects and encourages customers to demonstrate a commitment to the responsible practice framework that pertains to the relevant soft commodity e.g. Roundtable on Sustainable Palm Oil (RSPO), Roundtable on Responsible Soy (RTRS), Forest Stewardship Council (FSC) and The Programme for the Endorsement of Forest Certification (PEFC).

2020 Soft Commodities Compact Reporting

For the purposes of this report, customers who fall within scope of the FFA ESE sector risk appetite process are included. Then, following Compact guidance, only customers of Commercial Banking and NatWest Markets have been included where they are sourcing soft commodities from tropical regions. Source data was extracted May 2019 with First Line and Second Line of defence review in January 2020. RBS is a UK-centred bank and therefore has limited geographical focus on countries experiencing high risk of tropical deforestation. Through this customer analysis, best efforts to trace in-scope customers have been made.

To ascertain certification data for our customers, publicly available information has been used e.g. the certification schemes online databases. Limitations of this approach are recognised and through the BEI and The Compact, we are working with other financial institutions on improving data availability.

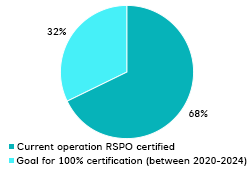

- Palm Oil - 100% of our customers (processors and growers) who fall into the scope are expected to be fully certified between 2020 - 2024.

- Soy - 100% of our customers who fall into the scope are RTRS certified, the extent of coverage is not reported.

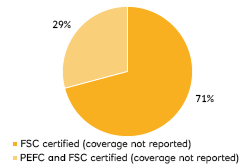

- Timber - 100% of our customers who fall into the scope are FSC only or FSC and PEFC certified.

Palm Oil

Timber

We’re now NatWest Group

Come and visit us for all our latest news, insights and everything NatWest Group.