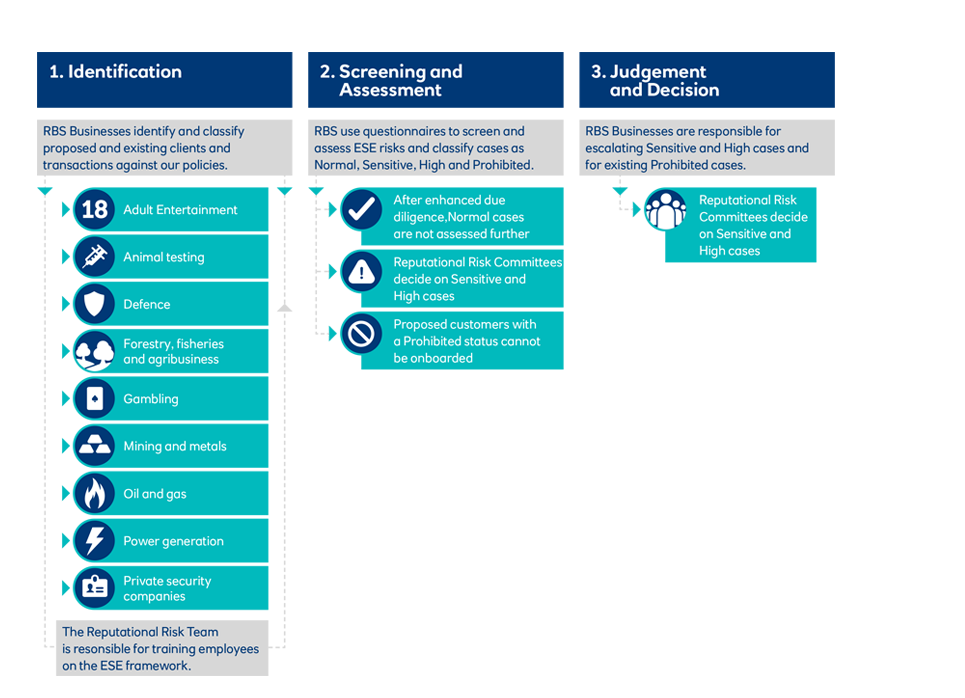

The activities of our customers can have environmental, social and ethical (ESE) impacts – including polluting activities and the potential for human rights infringements. To help us assess and manage these risks, we operate an ESE risk management framework which has been live since 2011. As part of this process, we conduct due diligence on customers, projects and transactions that present heightened ESE risk. We also expect our customers to adhere to local and international environmental, social and human rights standards.

RBS has developed ESE risk acceptance positions on industry sectors where enhanced due diligence is conducted. We also perform assessments on customers or transactions in other sectors where ESE Risk Concerns are identified.

Sector ESE risk acceptance positions define the level of ESE risk the bank is prepared to accept, and our expectations of companies to manage ESE risks in the relevant sectors. They are reviewed and updated regularly to take account of changes in regulation and good international practice for example managing climate change risk.

See process chart as PDF (69KB)

See process chart as PDF (69KB)

During 2019, training on ESE risk continued to be delivered to customer-facing businesses and functions, including focused training for specific teams. This training will better equip our staff to identify, assess and escalate issues with heightened ESE risk.

Summary of ESE risk assessments in 2019

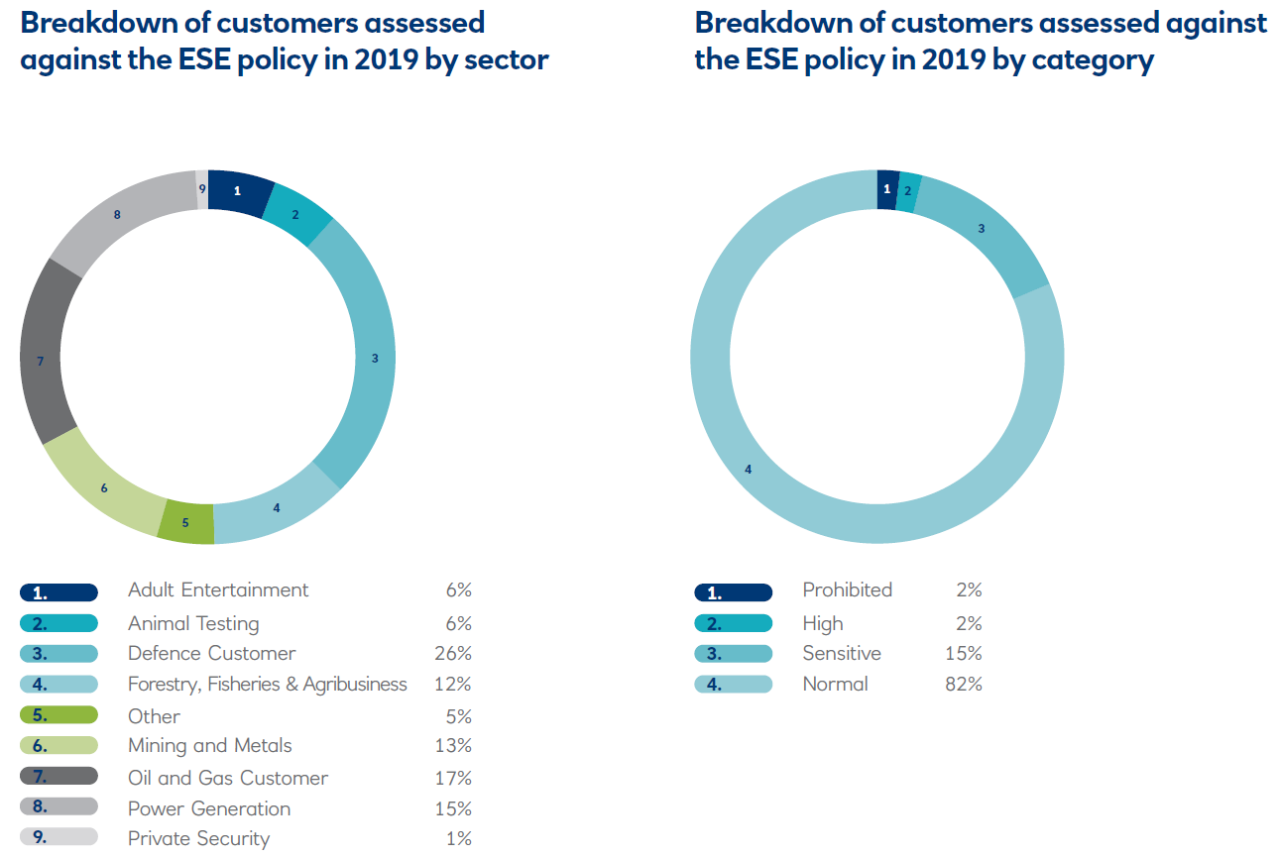

The graphs below show the number of corporate customers assessed against our ESE policy in 2019.

See customer chart as PDF(64KB)

See customer chart as PDF(64KB)

The total number of customer ESE assessments undertaken in 2019 (293) decreased by 24% compared to 2018 (386). Customer ESE assessments are represented in the above charts by sector and also by ESE Risk Category.

We also assessed 126 trade related transactions involving defence equipment and a small number of transactions involving goods destined for nuclear power plants. By comparison, in 2018 we assessed 177 defence-related transactions.

Non-personal customers involved in the gambling sector, covered by the ESE policy, have not been included in the above commentary, as a separate review and approval process is followed for them.