What's changing and why

Since 2013: International regulators began focussing on IBOR reform. With the number of interbank unsecured borrowing transactions reducing in recent years, there has been an increasing reliance on the expert judgement of panel banks on which to base LIBOR. This has led to concerns that LIBOR is no longer a representative or reliable benchmark reference rate.

July 2017: Andrew Bailey, Chief Executive Officer of the Financial Conduct Authority (FCA) announced that the FCA would not persuade or compel LIBOR panel banks to make LIBOR submissions beyond the end of 2021.

July 2018: The FCA and US Commodity Futures Trading Commission (CFTC), among other regulators and industry groups, told the global market they need to accelerate efforts to stop using products that reference LIBOR, and transition to alternate Risk-Free Rates (RFRs).

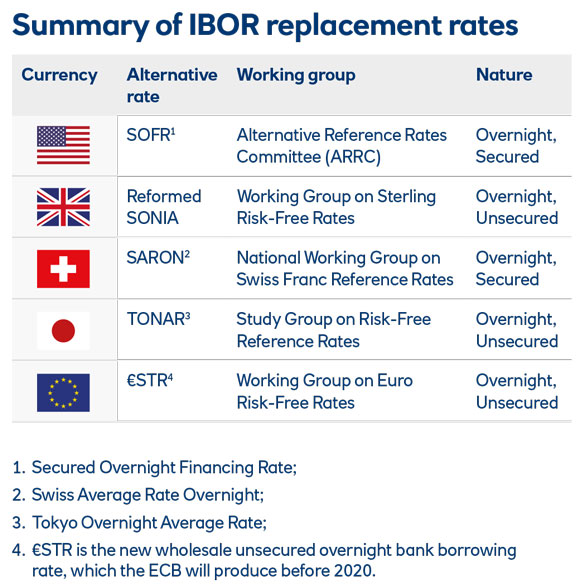

There are a number of Risk-Free Rates being considered

Working Groups have been set up to select alternative RFRs across all major currencies.

- The Bank of England’s Working Group on Sterling Risk-Free Reference Rates has recommended using the Sterling Overnight Indexed Average rate (SONIA) as its preferred option. This reference rate is already widely used in the derivatives markets with a growing number of Bonds using it as well. The requirement for a Term SONIA Reference Rate (TSRR) is actively being considered by the industry in conjunction with the Bank of England and the FCA.

- In the US the Alternative Reference Rate Committee (ARRC) has recommended the Secured Overnight Financing Rate (SOFR). The requirement for a Term SOFR is also being considered by the industry and the ARRC.

- The European Central Bank (ECB) has recommended the Euro Short Term Rate (ESTER) to replace the Euro Overnight Indexed Average rate (EONIA), which is currently not EU benchmark regulation compliant. ESTER is due to be published by the ECB from October 2019.

SONIA

LIBOR is a forward-looking term rate. However SONIA is a backward-looking, overnight rate based on actual transactions that have taken place the day before. Recognising that certain markets, for example cash and lending, may prefer forward-looking term characteristics, the Bank of England has gathered market views on a forward-looking Term SONIA Reference Rate (TSRR). A decision should be made later this year.

A summary of responses to the consultation can be found here.

*Externally hosted website. The Royal Bank of Scotland Group plc (RBS) is not responsible for the accuracy or content on this site.

Other content in this section

We’re now NatWest Group

Come and visit us for all our latest news, insights and everything NatWest Group.