Our updates

MoneySense extends support to parents

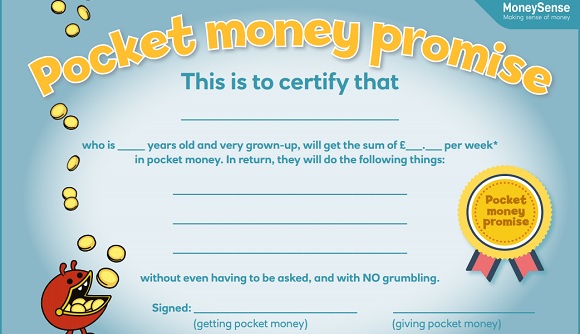

MoneySense, the bank’s flagship financial education programme, has launched materials to support parents who want to teach their children about money.