Overlay

Our updates

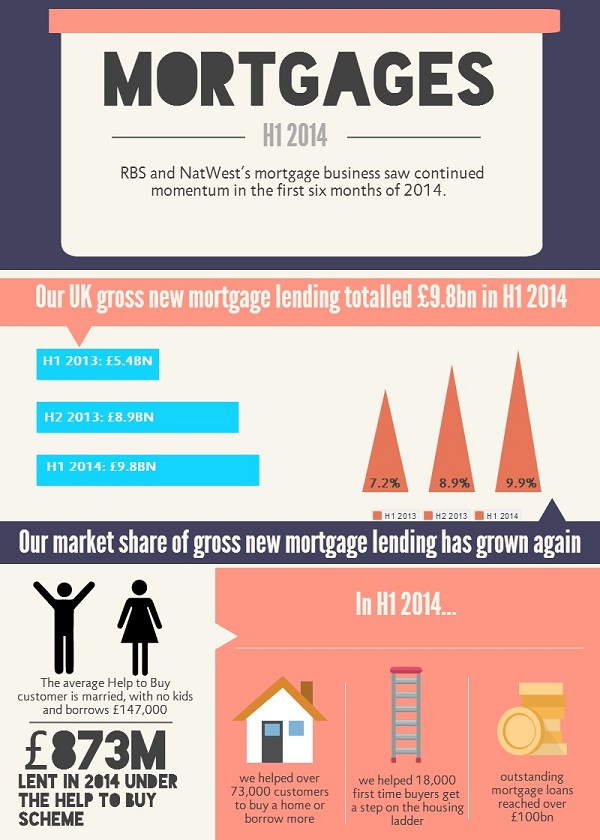

NatWest and RBS see strong customer demand for help to buy a home, with mortgage applications rising 38% in the first six months of 2014 versus the same period last year.

Our Updates

Supporting Individuals

Help to buy

Results

Mortgages

Housing

Press Release

2014