Climate and sustainable finance

Finance continues to play a key role in supporting the transition to a low carbon economy. We are working to support our customers’ ambitions to mitigate their emissions, save energy and reduce costs. We have over 25 years’ experience in supporting our customers in this sector – providing bespoke solutions to mitigate their emissions, funding their renewable energy generation, and financing innovative projects to spread new and more efficient energy technologies.

In March 2018, we announced our 2020 Sustainable Energy ambition:

With this ambition, we committed to funding £10bn to the Sustainable Energy sector by the end of 2020. This will include continued financing of low carbon generation and energy efficiency projects, as well as an increased focus on energy efficiency in real estate and alternatively-fuelled vehicles.

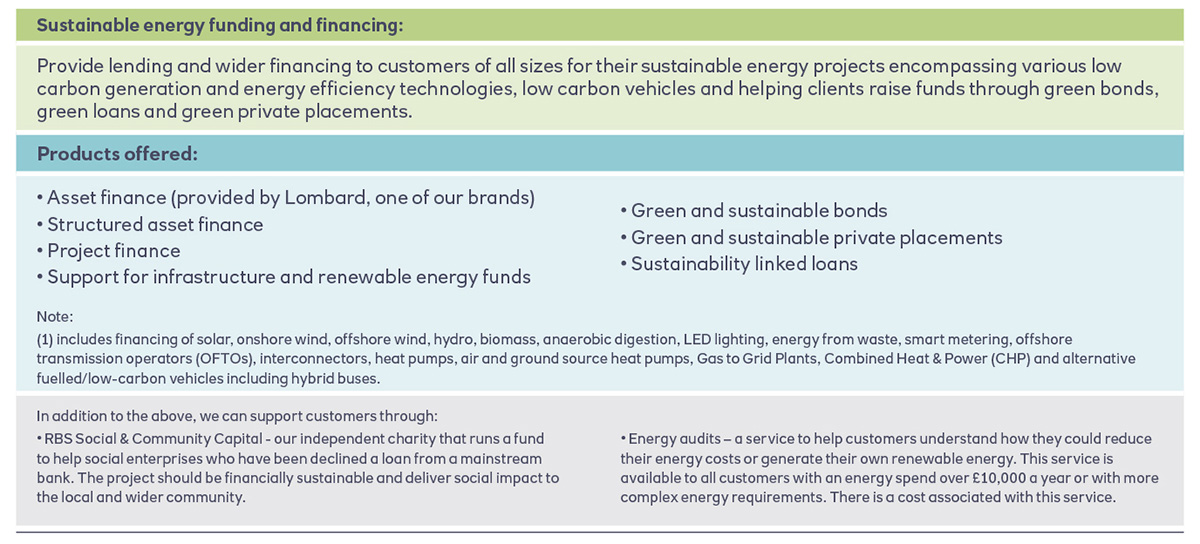

In 2019, we have continued to help our customers, both small and large, transition towards a low carbon economy by providing funding to the Sustainable Energy sector. This includes funding for various low carbon generation and energy efficiency technologies, low carbon vehicles and increasingly helping clients raise funds through green bonds, green loans and green private placements.

We have provided £9.9 billion of funding and financing to customers during 2018 and 2019 towards our commitment of £10bn to the sustainable energy sector by the end of 2020. We have also been externally recognised as a leading lender to the UK renewables sector by number of transactions over the past 10 years (2009-2019)*.

* Source: Inframation Deals League Table

Key highlights for the past year included:

- NatWest supported Derwent London plc (“Derwent”), the largest London-focused Real Estate Investment Trust, with a landmark green tranche revolving credit facility that meets the Green Loan Principles to support its sustainability objectives. The facility will help Derwent deliver innovative offices for today’s occupiers while offering improved energy efficiency and reduced consumption of natural resources.

- Lombard and Royal Bank of Scotland supported Stòras Uibhist, a community owned wind farm, to secure a 6.9MW windfarm on South Uist estates with the ability to generate an average 22, 695MWh a year, enough to supply 850 tenant crofters with electricity on South Uist, Eriskay and parts of Benbecula.

- NatWest and NatWest Markets supported Octopus Investments Limited with the refinancing of 7 operational UK onshore wind farms. The portfolio has an aggregated capacity of c. 230MW and all the assets have Renewables Obligation Certificates.

- RBS International supported Greencoat UK Wind plc with financing to acquire stakes 3 UK windfarms during 2019. Greencoat is the third largest owner of UK onshore wind and its 35 wind farms have a renewable energy generating capacity of 979MW, enough to power 940,000 homes.

- NatWest Markets supported Yorkshire Water with the first ever Sustainability Bond by a UK corporate issuer, listed on the London Stock Exchange. The innovative nature and success of the deal was highlighted in publications (Global Capital, Utility Week, Business Green and the Yorkshire Post) and an interview for a report on Green Finance in November’s edition of The Environment magazine. "All in all, the £350m 2041 sustainability bond represented a very positive approach by Yorkshire Water to the public bond market and a successful launch of its Sustainable Finance Framework with UK investors.”

- NatWest Markets launched its ESG Product Framework, the first of its kind in the market, to offer corporate and institutional investors the opportunity to subscribe to a range of NatWest Markets' shorter dated ESG-linked liquidity and funding products. NatWest Markets worked with PZEM N.V. to structure a deposit product within its ESG Product framework that allowed their deposit to obtain ESG benefits. Frank Verhagen CEO of PZEM: “At PZEM we always need to balance the interests of all our stakeholders, this also counts for how we invest our cash. Taking into account the current low interest rate environment and the prudent investment policy of PZEM, it is difficult to realize a return, let alone to expand our ESG policy to the finance function. We have valued the open dialogue with NatWest Markets on cash investment solutions for some time, but with the new ESG deposit they have managed to tailor a solution for us without compromising on any of our prudent investment policy ambitions.”

In February 2020, we set out a new ambition to be a leading bank in the UK & RoI helping to address the climate challenge. We have announced our new commitment to champion climate solutions, with an additional £20bn funding and financing for Climate and Sustainable Finance (2020-2022). The eligibility and inclusion criteria for the £20bn Climate and Sustainable Finance Commitment can be found here.

We are ever more committed to becoming a more sustainable bank, a more responsible company, doing business in a more sustainable way and helping our customers do so too.

If you're interested in finding out how we can help and support business customers please visit the relevant pages:

For more information about our new strategy and purpose please see the Strategic Report and supporting announcements.

We’re now NatWest Group

Come and visit us for all our latest news, insights and everything NatWest Group.