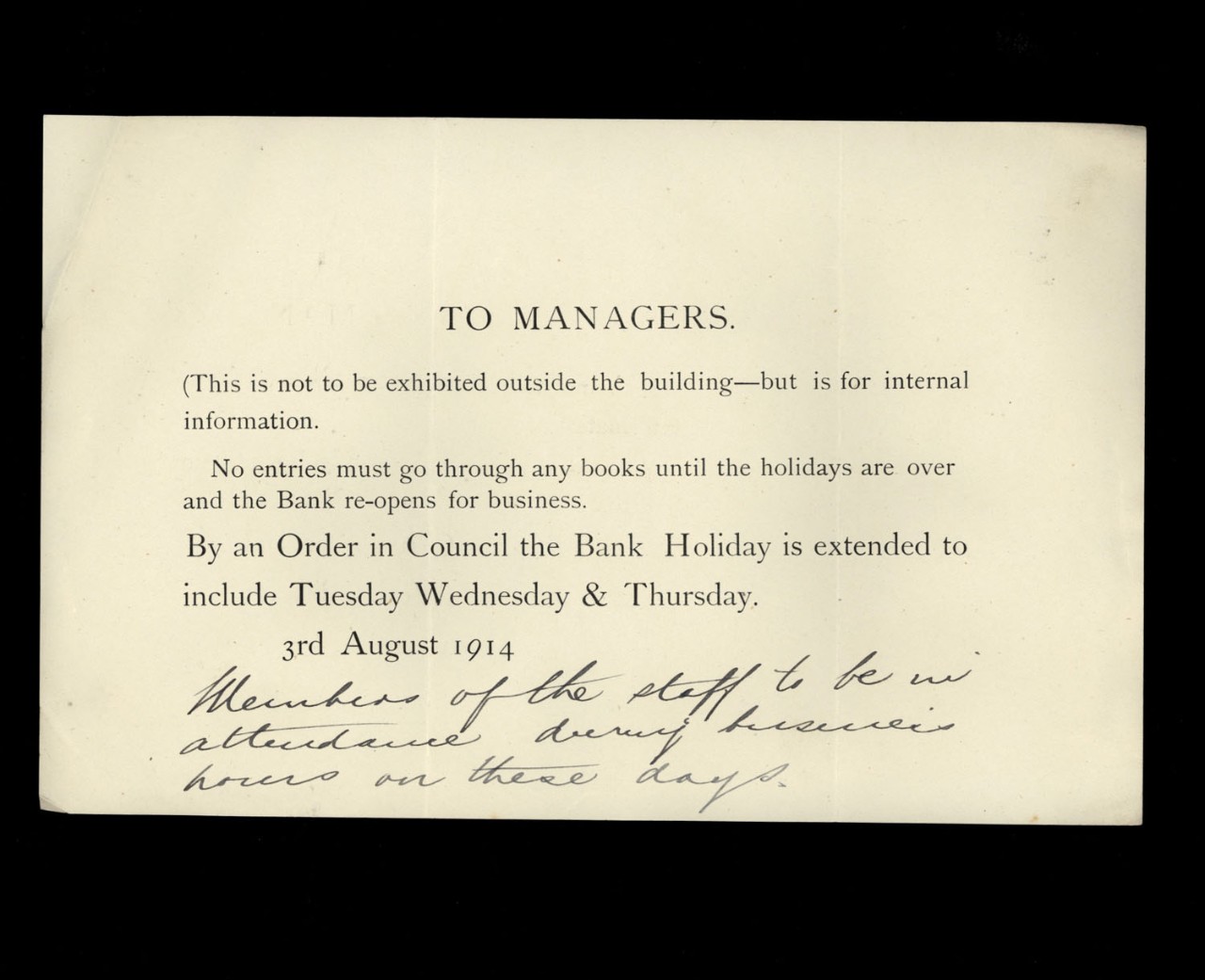

Object 76: Notice to branches, 1914

Notice to branch managers of Williams Deacon's Bank about the long bank holiday, 1914. © RBS

This little slip of paper discreetly instructs managers to keep their branches closed for an extra three days after the August bank holiday 1914. There's no explanation of why this was happening; no indication that for British people, these three days were to mark the end of a very tense week, and the beginning of four immensely difficult years. There's nothing to tell us, if we didn't already know, that this was the beginning of the First World War.

Austria had declared war on Serbia the previous Wednesday. Fear of a pan-European conflict instantly destabilised financial markets. Investors rushed to sell securities in favour of cash, overwhelming the world's stock exchanges and forcing them to close. The London Stock Exchange shut on Friday, and stockjobbers, brokers, discount houses and accepting houses also stopped operations, leaving most bank assets effectively frozen. Customer deposits, on the other hand, remained largely repayable on demand, and outstripped the banks' available liquid assets six times over.

Even before the Stock Exchange closed, newspapers were anticipating what would happenand reported that a run on the banks was expected. Panic set in, with customers queuing to exchange banknotes and account balances for gold. One London bank folded under the pressure, and instructions were sent out to all banks to protect their gold reserves and - where possible - resist any abnormal withdrawals. Most banks' boards met daily to monitor the developing situation.

| While the banks were closed the Treasury took action.

The Treasury saw that the only way to avert a crisis was to buy time. The following Monday was due to be a bank holiday, and the government announced that this would be extended until Thursday. Williams Deacon's Bank notified its branches of the closure with this printed notice. A hand-written note added that staff should come in as usual. They would continue to handle wages cheques and the needs of customers in genuine difficulty, although no entries were to be made in the bank's books. Branch doors 'should not be kept open but at most just ajar with a messenger or clerk in attendance'.

While the banks were closed the Treasury took action. It arranged to issue Treasury notes and announced a moratorium on payments. The bank rate was reduced. Meanwhile, the government explained to the public that they could help too by leaving money in the banks. The combination of measures worked; when the banks reopened there was no run. In fact, some branches even reported a surge in deposits by customers keen to do their bit in a patriotic cause. Not for the first time - or the last - Britain's domestic banks had been saved by government intervention.